Research Categories: Generative

Project Type: Research-Backed Persona Development

Role/Contribution: UX Researcher, UX Writer, Visual Designer, Illustrator

Timeline: 2.5 months

Relevant Tools: UserTesting, FigJam, Figma

Cross-Functional Team: UX Researcher, UX Manager, UX Designers

Stakeholder Teams: UX, Product, Engineering, Support, Sales, Deployment, Product Marketing.

Total Users: 5000+ external users of the Fraud Center Applications (2500+ customer banks)

High-Level Research Objective

Identify key TFC user roles and their their distinctions across different organisations

Uncover the responsibilities and pain points of TFC users

Study User Behaviours and Processes

Background

Value Statement:

The Fraud Center (TFC) is Mastercard’s Fraud Management Platform. To deliver a consistent, user-centred experience across TFC, it is essential to gain a deep understanding of who the users are, the requirements they face, and the features and functionalities they rely on to perform their roles effectively. Regularly updating user personas ensures we stay informed about their evolving needs, motivations, and behaviours, enabling a design process and platform that truly align with user expectations.

Feature Benefit Hypothesis:

A better understanding and empathising with users will be achieved by interviewing TFC users and updating user personas.

Research Goals:

Learn about what most troubles TFC users and identify the root causes of these concerns.

Explore the typical processes users follow to complete their tasks.

Study how users navigate between different tools and products within TFC to complete tasks.

Analyse the goals users aim to achieve during fraud investigation

Understand how the user’s organisation size/type influences their experience with TFC products

Methodologies

Personas Course:

Before initiating the Persona project, I attended Nielsen Norman Group’s “Personas: Turn User Data Into User-Centered Design” course. This training provided a comprehensive understanding of the distinctions between personas, archetypes, and proto-personas, along with effective synthesis methodologies. These insights guided the research approach for creating actionable user personas.

User Interviews:

I conducted seven interviews with active TFC users, representing diverse regions and organization sizes. Recruitment was done via email and outlook bookings. These interviews provided rich qualitative insights into user behaviors, challenges, and motivations.

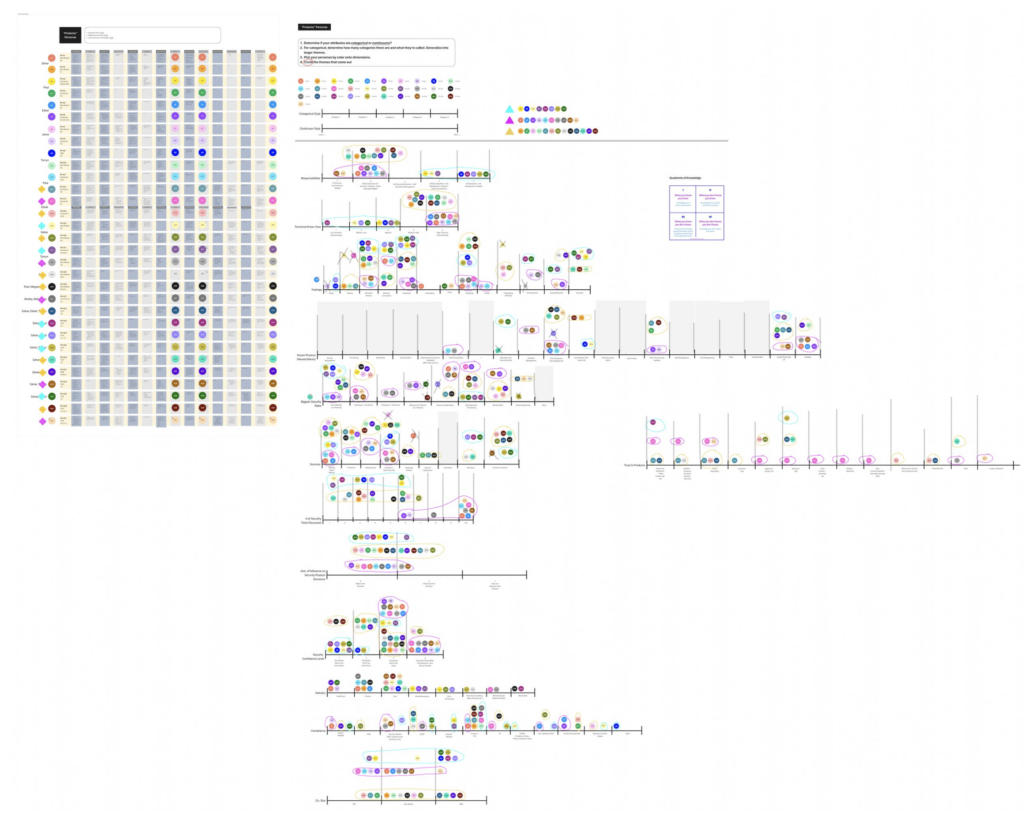

Segmentation Analysis – Attribute Exploration:

Following the interviews, I applied segmentation analysis techniques learned during the NNG course. This involved creating a table with column headers representing key attributes such as Feelings, Responsibilities, and Industry. Each row represented an interviewee, allowing for a detailed exploration of recurring themes across users.

Segmentation Analysis – Dimension Analysis:

Building on attribute exploration, I conducted dimension analysis to visualize user differences and groupings. Categorical dimensions created distinct categories (e.g., “Satisfied” vs. “Overwhelmed”), while continuum dimensions plotted attributes along a spectrum (e.g., “More Operational” to “More Technical” responsibilities). This exercise revealed natural clusters, helping differentiate user personas.

Persona Skeletons:

As a final synthesis step, I outlined persona concepts in FigJam, creating “Persona Skeletons.” These initial structures captured each persona in its entirety without a formal layout. This step allowed me to better visualise the distinctions between personas and refine their unique characteristics for further development.

Analysis

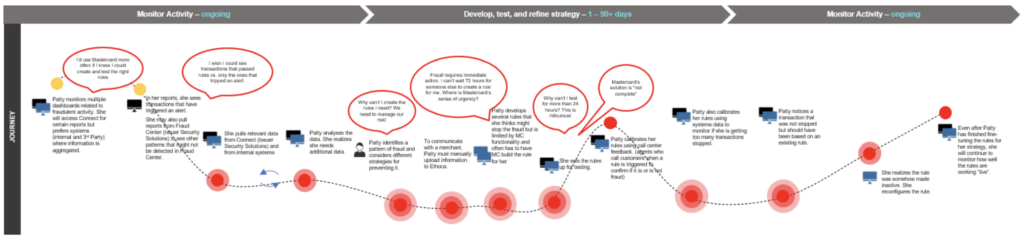

Journey:

Customer conducts research to support fraud prevention protocol review

End: Customer feels confident in understanding current fraud issues based on data review/reporting and can develop fraud prevention protocols.

Summary:

- 12 steps in the journey

- Many steps are repeated or revisited, as needed

- Fraud analysts are driven by overall strategies rather than task or queue-driven

- A fraud analyst may be assessing multiple existing or in-test strategies, while continuing to monitor for new patterns of fraud

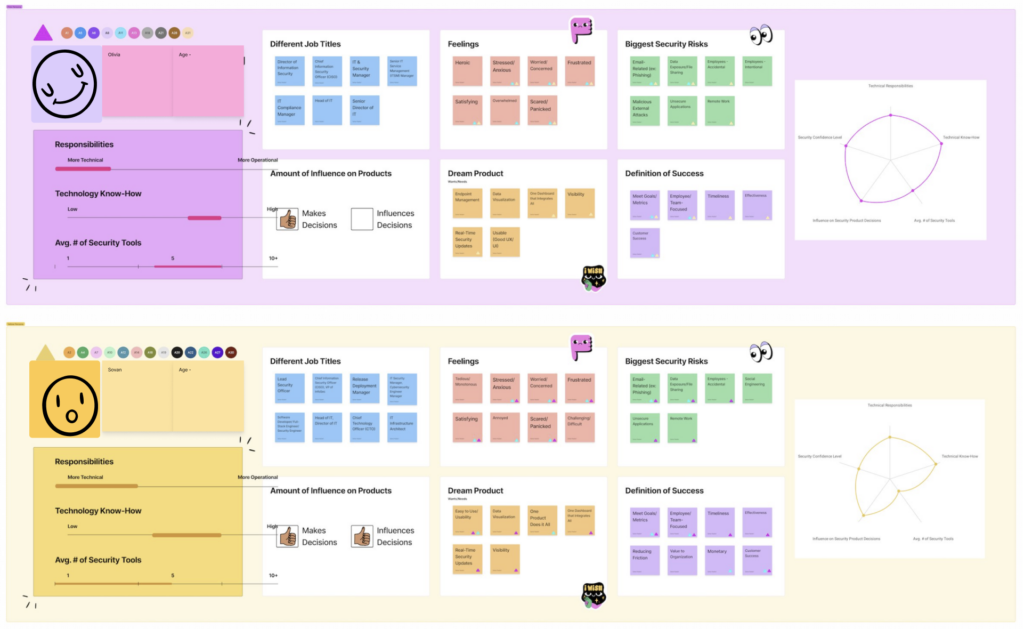

Skeletal Persona

Insights

The personas did not divide along market size or by region

- Rather, all market sizes were represented within these two personas

- More important were their feelings, the number of security tools their company uses, etc.

Interesting Observations

- Doesn’t realise how much they know because they feel there is always more to learn, especially in cybersecurity.

- Knows what they know

- Knows what they don’t know

- Doesn’t know what they don’t know

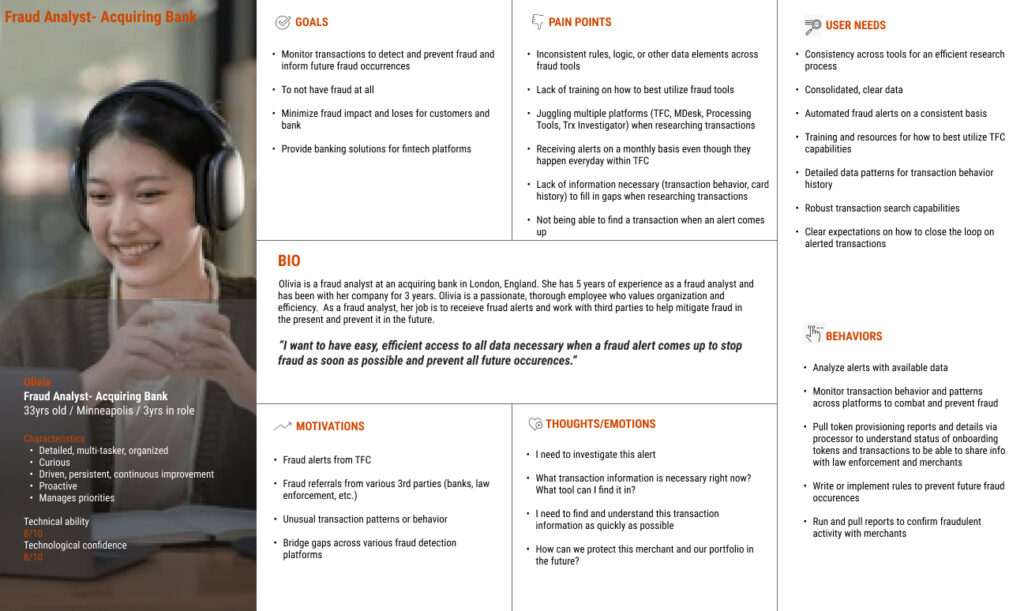

Personas

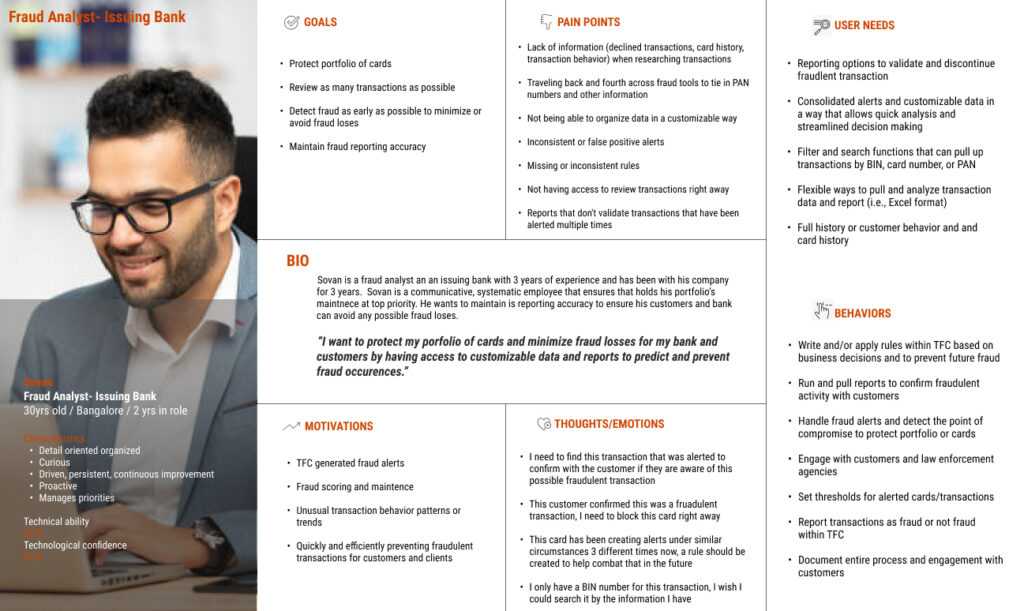

From our research we identified two key TFC personas

- Fraud Analyst- Acquiring Bank

- Fraud Analyst – Issuing Bank

Research Impact

UX Team

- Offers a clear understanding into the security requirements and expectations of users.

- Researchers and designers can reference these personas over and over in future projects.

Product Team

- Allows product managers to make informed decisions about feature development.

- Guides the creation of security-focused features and functionalities that align with the needs and pain points of Protectors.

Engineering Team

- Provides insight into who engineers are building for and what their security needs are.

- Personas can be used as shorthand in engineering and technology conversations when referencing this user type.

Customer Success, Customer Support, and Sales Teams

- These teams use the personas in training and onboarding new team members.

- Provides guidance on how to recognize the different personas and how best to communicate with each of them.

Marketing Team

Marketing has used the personas when writing blog posts and Voice of the Customer posts.

Assists in positioning the product as a secure solution and in targeting marketing campaigns more effectively.