Research Categories: Evaluative

Project Type: Conducting customer satisfaction surveys

Role/Contribution: UX Researcher

Timeline: Ongoing for multiple applications, 2.5 months per application

Relevant Tools: Qualtrics, FigJam, MS Teams

Cross-Functional Team: UX Researcher, UX Manager, UX Designers

Stakeholder Teams: UX, Product, Engineering, Support, Sales, Deployment, Product Marketing.

Total Users: 5000+ external users of the Fraud Center Applications (2500+ customer banks)

Value Statement

To better understand user needs and build a consistent user experience for the TFC platform, we believe delivering regular, consistent CSAT surveys for products hosted on TFC will help provide an understanding of satisfaction, usability, and user needs on an ongoing basis.

Feature Benefit Hypothesis

We believe that consistently evaluating the satisfaction and effect of TFC-hosted products on a user’s daily tasks will be achieved if [DMP UX] successfully completes consistent CSAT Surveys so that a consistent user experience can be built for the TFC platform.

Methodological Improvements in the 2024 Survey Format

To increase the validity of the data collected and enhance response rates, several key methodological improvements were made based on learnings from the 2023 surveys:

- Targeted Survey Distribution

In 2023, surveys were distributed specifically to active users identified through platform usage data. This targeted approach significantly improved response rates by ensuring the survey reached engaged users who were more likely to provide meaningful feedback. - Reduction of Open-Ended Questions

The 2023 survey format included fewer open-ended questions, which led to higher completion rates and improved data analysis. By reducing the cognitive load on respondents, we observed a marked decrease in “N/A” or repetitive responses, enhancing the overall quality of the data. - Introduction of a Singular Improvement Question

A single, focused question on areas of improvement was introduced for all respondents. This change facilitated:- Increased Feedback Diversity: Broader participation from users who might not have otherwise provided open-ended feedback.

- Reduction of Unhelpful Responses: Limited instances of non-actionable responses.

- Positive Feedback Capture: Enabled collection of constructive positive comments.

- Ease of Thematic Analysis: Streamlined the categorization and analysis of feedback themes.

CSAT Strategy

The CSAT strategy for TFC products follows a structured timeline and careful user targeting:

- Timing: Surveys are conducted after major product enhancements, allowing 3-4 months for users to adapt to changes. Additionally, annual surveys are conducted.

- User Targeting:

- User lists are curated based on platform usage.

- Overlap analysis ensures efficient survey distribution when applications share a significant user base.

- To avoid survey fatigue, no customer receives more than one survey within a three-month period.

This strategic planning ensures a balanced approach to feedback collection without overwhelming users.

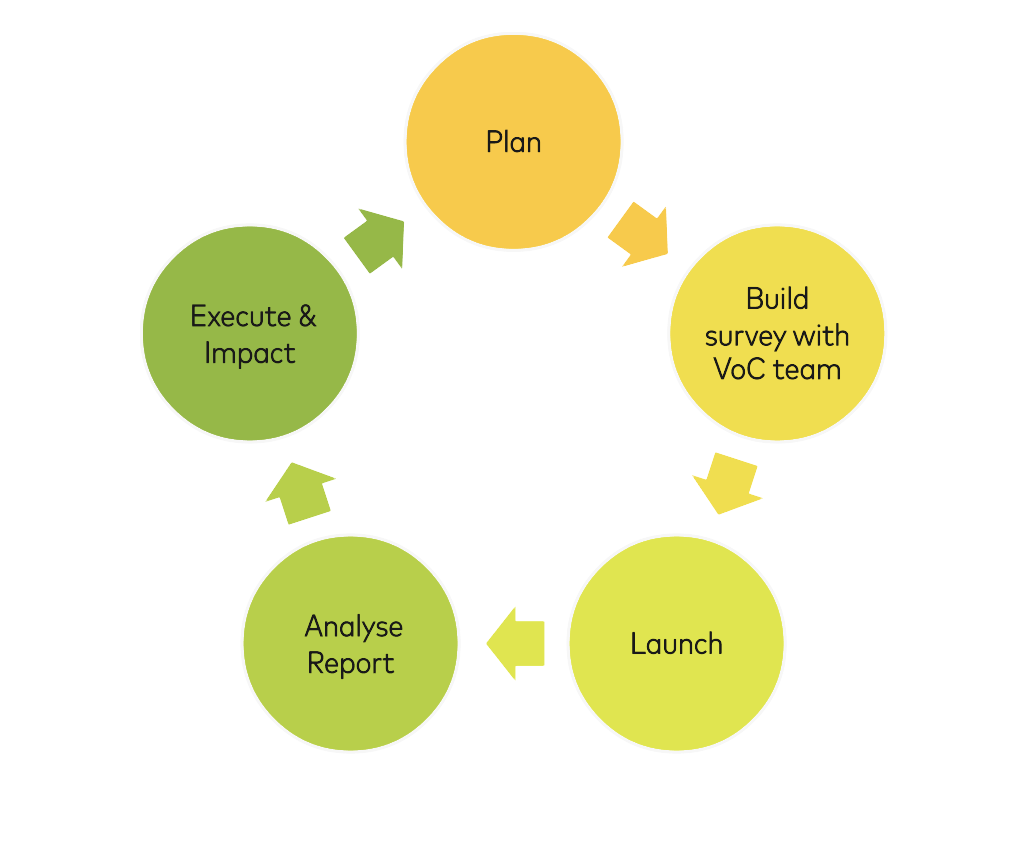

Survey Process

The CSAT survey process involves close collaboration with product teams and follows a rigorous sequence:

- Planning and Alignment:

- Define business objectives for the survey.

- Review product improvements since the previous CSAT round.

- Question Design:

- Finalisation of survey questions, incorporating various formats such as:

- Single Select Questions: For clear, actionable insights.

- Open Text Questions: For qualitative feedback.

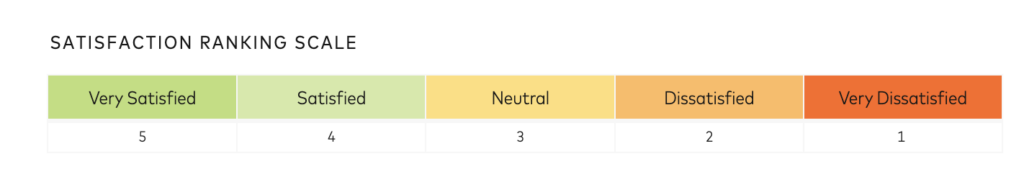

- Satisfaction Ranking: To gauge user sentiment quantitatively.

- Finalisation of survey questions, incorporating various formats such as:

- Survey Administration:

- Distributed via Qualtrics.

- Survey remains open for three weeks.

- Two reminder emails sent to maximize response rates.

- Data Analysis:

- Analysis conducted using FigJam and Qualtrics.

- Key metrics analyzed include response rates, regional response distribution, and comparative analysis against previous CSAT rounds.

- Identification of satisfaction trends, usability concerns, and areas for improvement.

Analysis Methodology

A mixed-methods approach is employed to analyze survey data:

- Quantitative Analysis:

- Satisfaction scores are compared year-over-year to track changes in user sentiment.

- Response rates and regional distributions provide insights into engagement patterns.

- Qualitative Analysis:

- Thematic coding of open-text responses allows for the identification of recurring user concerns and positive feedback.

- Comparative analysis of improvement suggestions helps prioritize product development initiatives.

- Benchmarking:

- Comparison with historical CSAT data to assess progress and identify persistent pain points.

Key Insights Collection

Key insights from Customer Satisfaction (CSAT) surveys are crucial for understanding how customers feel about a product and identifying areas for improvement. Here’s an overview of the key insights you can gather:

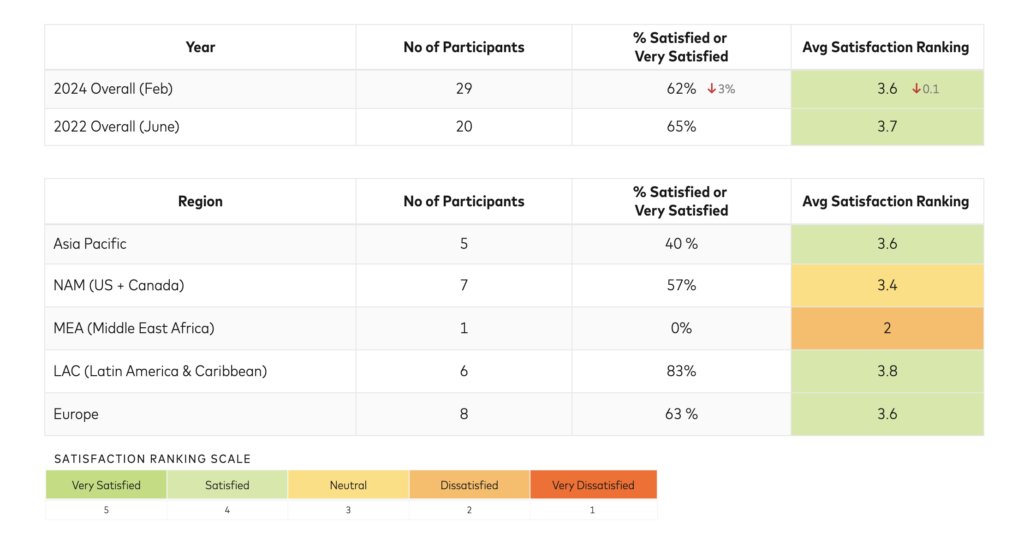

Tracking CSAT over time enables teams to observe trends in customer sentiment. This is essential for assessing the impact of changes made to the product, as well as tracking how improvements or new releases are influencing customer satisfaction.

Overall Satisfaction Rating by Region:

This breakdown reveals how different regions perceive the product, highlighting potential regional differences in satisfaction. Variations in feedback can be influenced by regional preferences, support quality, or cultural factors. Identifying these differences allows for more targeted improvements and localized strategies to enhance user experience.

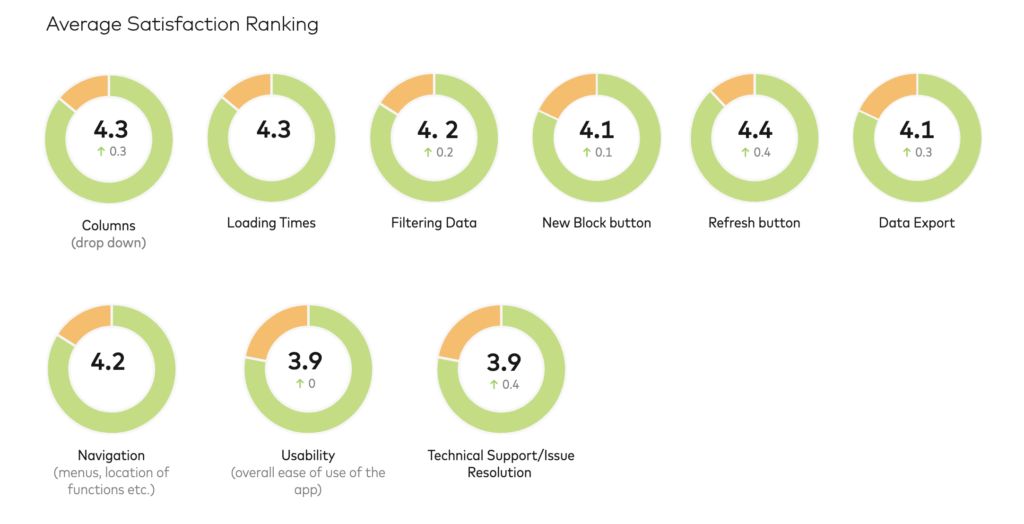

Feature and Functionality Breakdown:

By analyzing satisfaction scores for individual features and functionalities, you can pinpoint which aspects of the product are meeting customer expectations and which need attention. This allows product teams to prioritize development efforts, addressing areas with low satisfaction and enhancing high-performing features.

Leverage CSAT to Gauge Interest in Potential Enhancements:

CSAT scores can be cross-referenced with market research findings to assess interest in potential product enhancements. If customers show strong satisfaction with a certain feature, they may express a preference for its expansion or improvement. Conversely, features with lower satisfaction scores can guide the development of new enhancements that align with customer needs.

Market Comparison and Benchmarking:

Comparing your product’s CSAT results with competitor products helps gauge where your offering stands in the market. Benchmarking allows for identifying industry standards, competitive advantages, and areas where your product might be falling short. This information is vital for positioning your product more effectively and ensuring that it meets or exceeds customer expectations.

Trend Analysis:

Business Impact

The CSAT surveys have provided valuable insights that directly influence product development and strategic decisions. Key findings include:

- Enhanced Usability: Feedback from users highlighted specific usability pain points, leading to targeted enhancements that improved user task efficiency.

- Feature Prioritisation: Analysis of improvement suggestions informed the roadmap, ensuring that high-impact features aligned with user needs were prioritized for development.

- Regional Preferences: Comparative analysis by region revealed distinct user preferences, allowing for tailored communication and feature deployment strategies.

- Increased Engagement: By addressing common user concerns surfaced through the surveys, the platform witnessed higher engagement rates and user satisfaction scores.

Business Impact:

- Improved Retention Rates: Enhanced user satisfaction translated into improved customer retention.

- Data-Driven Decisions: The CSAT findings have become a crucial input for data-driven decision-making processes across product teams.

- Strategic Alignment: Insights from the surveys have ensured that product enhancements align with both user needs and business objectives.

Reflections & Learnings

Through conducting CSAT surveys, several important learnings have emerged:

- Survey Design: The reduction of open-ended questions and introduction of targeted improvement questions proved effective in increasing response rates and data quality. This highlights the importance of balancing quantitative and qualitative questions to minimize respondent fatigue.

- Timing and Distribution: Strategic timing of surveys, particularly after major product enhancements, was crucial to capturing relevant and actionable feedback. Ensuring a three-month gap between surveys per customer also mitigated survey fatigue.

- Data Utilization: The ability to translate survey findings into actionable insights has been pivotal. Clear themes emerging from qualitative responses helped shape both short-term and long-term product development strategies.

- Cross-Functional Collaboration: Partnering closely with product teams ensured alignment between survey objectives and business goals, fostering a culture of continuous improvement.

- Continuous Improvement: The iterative approach to refining survey methodology, distribution strategies, and data analysis techniques underscores the value of adaptability in user research.

Conclusion

The ongoing CSAT initiative for TFC products is a testament to our commitment to delivering user-centric experiences. By continuously refining survey methodologies and strategically planning feedback collection, we have created a robust framework for understanding user satisfaction and needs.

These insights directly inform product decisions, ensuring that the TFC platform evolves in line with user expectations and business objectives. Our data-driven approach underscores the importance of actionable feedback in driving meaningful product improvements and enhancing the overall user experience.